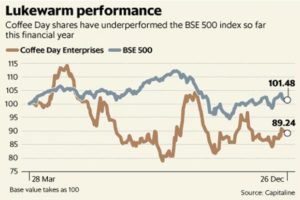

“Coffee is a beverage that puts one to sleep when not drank,” said French humorist Alphonse Allais. Investors in Coffee Day Enterprises Ltd might be tempted to think the company is in need of some sort of a caffeine boost. After all, Coffee Day shares are down 18% compared to its November 2015 IPO price of ₹328. They had briefly risen above the issue price early this year, before falling to the ₹270 levels.

“Coffee is a beverage that puts one to sleep when not drank,” said French humorist Alphonse Allais. Investors in Coffee Day Enterprises Ltd might be tempted to think the company is in need of some sort of a caffeine boost. After all, Coffee Day shares are down 18% compared to its November 2015 IPO price of ₹328. They had briefly risen above the issue price early this year, before falling to the ₹270 levels.

Mint had recently reported that Coffee Day chairman and managing director V.G. Siddhartha is looking to offload his and the company’s stakes in Mindtree Ltd. Coffee Day Enterprises owns a 17.1% stake in mid-cap IT company. Based on the company’s market capitalization on Wednesday, the shares are worth about ₹2,390 crore.

The news should have excited investors. After all, Coffee Day’s market cap is currently ₹5,700 crore, and investors typically apply a holding company discount of 25-30% to investments. Even so, the news reports have barely caused the Coffee Day shares to budge, increasing just about 3% since Mint reported on 6 December that it was looking to sell its stake in Mindtree. Understandably, investors are waiting an official announcement. News reports also suggest that Mindtree promoters are not keen on giving up control, which, in turn, means that some buyers may get put off.

Coffee Day shares have underperformed the BSE 500 index so far this financial year. Some attribute the miserable show to the holding company structure and its presence across businesses, which results in investors assigning a conglomerate discount. That apart, there is high debt on its books.

The sale of the Mindtree stake will prove to be a positive development, as it would lead to value unlocking of the investment for Coffee Day investors, said Jigar Shah, CEO, Maybank Kim Eng Securities India Pvt. Ltd. In its September quarter earnings conference call, the company had said that its net debt stood at ₹3,600 crore.

Selling the Mindtree stake will also pave the way for the restructuring of the company, said Shah. Last month, Coffee Day said it was evaluating the segregation of the coffee and non-coffee businesses. Its board had also approved the appointment of financial, tax and legal advisors to explore the matter.

After the proposed simplification of its holding structure, investors should be able to invest in its coffee business directly, potentially enabling a fresh price discovery, said a report from Maybank on 30 November. Coffee Day, perhaps, needs to take its own tagline—a lot can happen over coffee—seriously. If the non-coffee businesses are hived off or sold, valuations may get the caffeine boost investors were desperately waiting for.

The development was reported by livemint.com