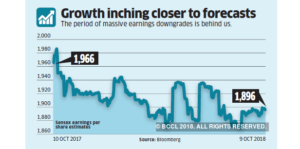

Though the stock market continues to be jittery, corporate results for the second quarter are expected to be good. “Due to the low base effect, there should be double digit bottom-line growth for Nifty earnings in the second quarter as well,” says Mihir Vora, Director and CIO, Max Life Insurance. Hiccups in GST implementation are the reason for this low base.

Though the stock market continues to be jittery, corporate results for the second quarter are expected to be good. “Due to the low base effect, there should be double digit bottom-line growth for Nifty earnings in the second quarter as well,” says Mihir Vora, Director and CIO, Max Life Insurance. Hiccups in GST implementation are the reason for this low base.

However, the outlook for the third and fourth quarters is not that bright as the low base effect would wane. Also, changes in the market environment have made things difficult for corporates. “Due to the sudden movement in crude oil prices, rupee-dollar rate, rising interest rate, the debt market crisis, etc., the second half will be difficult for most companies,” says Vora.

Let’s see what the second and also subsequent quarters hold for the various sectors.

Finance: Since major problems have surfaced only recently, the second quarter results of non-banking financial companies (NBFCs) won’t be impacted much. NBFCs are expected to report a decent 17% net profit growth in the second quarter. However, the rise in interest costs may impact their growth in subsequent quarters. “Since dependence on short-term borrowings needs to be reduced and funding sources need to be recalibrated by reducing dependency on the MF industry, growth rate of NBFCs will slow,” says Rajesh Cheruvu, CIO, WGC Wealth. NBFCs that weren’t fully utilising their bank credit lines because of cheaper funds from the debt market have the option of going back to banks for funding. However, bank funding will be costlier and impact NBFCs’ net interest margins in the coming quarters.

As far as banks are concerned, PSU banks remain under pressure due to NPA-related issues. Private sector banks continue to do well due to the market share shift from PSU banks towards private banks. This trend is expected to continue in the coming quarters as well.

FMCG: “Consumer staples did well in the first quarter due to the base effect, but may disappoint in the second quarter as base effect waned in the second quarter,” says Cheruvu. In fact, high base effect for consumer stables segment will come into play in the second quarter because of the post-GST sales pick up in July-September 2017. The festive season shifting by a month will also have an impact on this sector. However, no major problem is expected because of the pick-up in rural consumption.

Auto: “Besides the high base effect and shifting of festivals, the performance of the auto sector in the second quarter was also marred by one off incidents like uneven rainfall distribution and linking of 2-wheeler ownership to driving licence in Bengal,” says Pankaj Pandey, Head, Research, ICICI Direct. The auto segment will also face problems in the coming quarters because a large number of auto sales are currently funded by NBFCs and slowdown in NBFCs will hurt the auto segment in the coming quarters.

Media and metals likely to shine

Estimates for the second quarter. Source: PL Report

Cement: The expected net profit growth for the cement sector is lower than the expected growth in revenue because companies are trying to increase volume and market share at the cost of realisations. Unabated increase in fuel cost is another factor that has hit their margins.

Real estate: Just when the realty sector was just coming out of its problems, it’s funding is likely to be impacted due to the slowdown in NBFCs. “Since a major part of the domestic consumption growth is fuelled by credit from NBFCs, slowdown in NBFC loan growth will impact consumption growth,” says Vora.

Oil and gas: “Since the prevailing refining margins are good, oil marketing companies and refiners like Reliance Industries should do well in the second quarter,” says Cheruvu. However, high crude prices can be worry, especially for PSU oil companies, in the third and fourth quarters because as we are getting into the election season, the government may not allow them to increase prices.

IT & Pharma: Due to the continued fall in the rupee, export-related sectors such as IT and pharma should see good revenue growth. “In addition to weakness in rupee, new opportunities are also helping the IT sector. It should continue to do well in the coming quarters,” says Vora. Investors will have to take stock-specific views when it comes to the pharma sector. “Pharma Companies that came out of US FDA issues may do well in the second quarter,” says Cheruvu.

The development was reported by retail.economictimes.indiatimes.com